Want to know which used car is the cheapest to insure in California? Well, we’ve got you covered.

Keep reading, and we’ll help you budget and save money on insurance when choosing a used vehicle to purchase.

What Used Cars Are the Cheapest to Insure in California?

Many factors go into rating insurance, but historically small SUVs, minivans, and pickup trucks are the most affordable types of vehicles to insure. They have lower claim frequency, meaning these vehicles get into fewer accidents than other types of vehicles (sports cars or luxury cars).

On top of a lower likelihood of having an accident, SUVs, minivans, and pickups have higher safety ratings which further decrease the price of insurance. If in doubt, consider these types of vehicles first if you are trying to find a used car to insure on the cheap.

Cheapest Make and Models in California

By the numbers, Subaru beats out all the other car manufacturers for the used car with the cheapest insurance.

The Subaru Forester and its counterpart, the Outback, were on the top of the list with an average full coverage cost of insurance of $1,524 and $1,608, respectively.

Other notable brands included Jeep, represented in the top three most affordable used cars to insure with its Wrangler model. The average full coverage cost for the Jeep Wrangler’s base model was slightly higher than the Subaru Forester and Outback at $1,716 per year.

Overall, the cost to insure a full-coverage vehicle ranged from $1,524 annually to $2,208, while the average cost was $1,831.43.

To compile this data, we gathered insurance quotes via online quoting portals using a basic driver profile: 35-year-old male, California resident, no tickets/accidents. Focusing specifically on California insurance rates allows us to gather more accurate data than nationally-averaged insurance rates. National averages are wildly inaccurate because they don’t consider the state-to-state variance in premiums.

Our complete research methodology is detailed further down in this article.

| Make | Model | Monthly Price | Annual Price |

| Subaru | Forester | $ 127.00 | $ 1,524.00 |

| Subaru | Outback | $ 134.00 | $ 1,608.00 |

| Jeep | Wrangler | $ 143.00 | $ 1,716.00 |

| Honda | Accord | $ 143.00 | $ 1,716.00 |

| Mazda | CX-5 | $ 149.00 | $ 1,788.00 |

| Chevrolet | Equinox | $ 149.00 | $ 1,788.00 |

| Ford | 150 | $ 152.00 | $ 1,824.00 |

| Ford | Explorer | $ 155.00 | $ 1,860.00 |

| Toyota | Tacoma | $ 156.00 | $ 1,872.00 |

| Nissan | Rogue | $ 157.00 | $ 1,884.00 |

| Toyota | RAV4 | $ 159.00 | $ 1,908.00 |

| Honda | CRV | $ 160.00 | $ 1,920.00 |

| Toyota | Camry | $ 169.00 | $ 2,028.00 |

| Jeep | Grand Cherokee | $ 170.00 | $ 2,040.00 |

| Toyota | Corolla | $ 171.00 | $ 2,052.00 |

| Toyota | Highlander | $ 174.00 | $ 2,088.00 |

| GMC | Sierra | $ 174.00 | $ 2,088.00 |

| Ram | 1500 | $ 175.00 | $ 2,100.00 |

| Chevrolet | Silverado | $ 176.00 | $ 2,112.00 |

| Honda | Civic | $ 176.00 | $ 2,112.00 |

| Tesla | Model Y | $ 184.00 | $ 2,208.00 |

Which Used Vehicle Brands Are Cheapest for Insurance?

Regarding insurance costs, the three most affordable used car brands are Subaru, Ford, and Toyota. All three brands have established reputations within the car industry due to their reliability and safety ratings.

The majority of Toyota’s vehicle models, including the RAV4, Tacoma, 4Runner, Highlander, Corolla, and Camry, all have stellar ratings in the Insurance Institute for Highway Safety’s Top Safety Picks. All of their models for 2022 have either the coveted Top Safety Pick+ rating (the best) or the Top Safety Pick rating, and their previous years have amazing ratings too.

Safety ratings of used vehicles are one of the primary factors that help insurance companies determine insurance rates. Another factor (that often coincides with safety ratings) is if the car has low repair costs.

Research Methodology

For our research, we used most vehicles listed in Kelly Blue Book’s “20 Best Selling Vehicles of 2021” as our case study, then added a few of our favorites.

We then ran quotes through an online quoting tool using a basic profile with the following attributes:

- 35-year-old male

- California residence

- Continuously insured for 5+ years with the same carrier

- Bachelor’s degree

- No accidents/tickets/violations

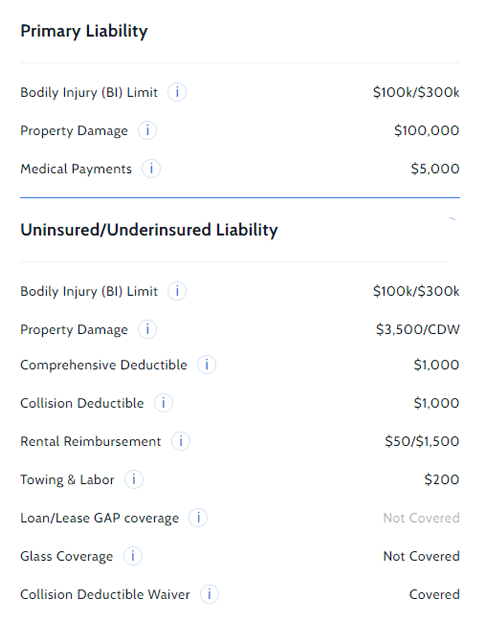

We also used a basic structure for coverages, including comprehensive and collision on each vehicle at a $1,000 deductible. Here’s a full breakdown of our coverage choices for the quotes compiled:

Frequently Asked Questions

Is Car Insurance Cheaper if you Bundle?

Car insurance is always cheaper if you bundle other policies. Insurance companies give large discounts to encourage their clients to bundle renters, home, and life insurance.

Are older or newer cars cheaper to insure?

Older vehicles are cheaper to insure. Vehicles depreciate over time, so older vehicles minimize the amount an insurance carrier would have to pay if there’s a claim.

Cars vs. SUVs – Which is Cheaper to Insure?

SUVs are cheaper to insure than cars because of their higher safety ratings, affordable replacement parts, and lower accident rates.

Should I have full coverage on a used car?

Full coverage can prevent you from paying a loan on a totaled car you can’t drive anymore. However, if you don’t have a loan and your car isn’t worth much, replacing the car may be something you can afford out of pocket, and full coverage may be unnecessary.

References

- IIHS-HLDI: Crash Testing & Highway Safety. (n.d.). IIHS-HLDI Crash Testing and Highway Safety. Retrieved October 28, 2022, from https://www.iihs.org/ratings/top-safety-picks/2022/all/toyota#award-winners

- What’s My Car Worth? Get Blue Book Used Car & Trade-In Values | Kelley Blue Book. (n.d.). Www.kbb.com. https://www.kbb.com/whats-my-car-worth/

- Young Driver Safety: The Truth Behind The Statistics – Citizen. (n.d.). Campuspress.yale.edu. Retrieved October 28, 2022, from https://campuspress.yale.edu/citizen/young-driver-safety-the-truth-behind-the-statistics/

- The 20 Best-Selling Vehicles of 2021. (2022, January 10). Kelley Blue Book. https://www.kbb.com/car-news/the-20-best-selling-vehicles-of-2021/

Jesse Cunningham V is a professional writer and licensed insurance agent. He has worked in the insurance industry in different capacities, starting as a customer service representative and working his way up to an independent agency owner. He is licensed in the states of Maryland and Pennsylvania for Property, Casualty, Life, and Health products. Jesse has worked with many national carriers, including Nationwide, State Farm, Travelers, and Liberty Mutual, and specializes in car and home insurance and health, life, accidental death, and disability insurance. He writes for multiple publications including FIXD and Bauple.com. All articles by Jesse are opinion-based. Speak with your licensed insurance agent about the particulars of your insurance before making any decisions.